Free Up Your Funds: 8 Great Payment Options For Freelancers

While it may be in the name, the work you do while freelancing is definitely not free. However, considering over half (55%) of freelancers say they’ve done work they haven’t been paid for, and 40% say they’ve been paid at least two weeks late by a client, you’ll likely experience payment issues at some point in your freelance career[1].

That said, while you may not be able to influence the urgency with which your clients pay you, there are some steps you can take to maximize your chances of getting paid on time. One of these critical steps is choosing a suitable freelance payment method.

Below we look at eight great payment options for freelancers and break down the pros and cons of each, so you can make sure there really isn’t such thing as a free lunch, all while keeping your pockets full.

The right method pays:

As a freelancer, you set the terms, so as much as it’s important to establish the amount you’ll be paid, it’s just as (if not more) crucial to consider your payment options. Payment methods not only have a significant impact on how you get paid but whether or not you actually do.

Your form of payment should depend on the business. While some may be more appropriate than others in certain circumstances or for specific projects, they can also vary depending on location.

While the primary purpose of all payment methods is to safely and securely transfer money from one party to another, each method has its benefits and drawbacks that may help or hinder you from collecting your well-earned coins.

Stripe:

While Stripe is less familiar than other payment portals, it’s actually very easy to use for both the client and freelancer and registering is quick and free. Payment can be made either via credit cards or using a bank account.

Stripe also has some of the best security and customer protection, so if you are subject to fraud, they will cover any losses incurred. Payment is also processed automatically, so once funds have been transferred to Stripe, they are available for use immediately.

The main downside of Stripe is that it does not operate internationally (yet), so if you are looking to take jobs from overseas clients then this might not be the best payment method for you.

Additionally, the fact that Stripe is still relatively unknown may see some reluctance from clients to use it. However, given how easy it is to set up and the great security features offered, this could start to change in the near future.

PayPal:

Another popular payment gateway for freelancers, Paypal allows customers to pay with various payment methods, including cards, bank transfers and Paypal balances.

Clients can pay you as soon as you complete your work since payment is transferred into your account immediately, where you can either transfer funds to your bank or use a Paypal debit card to spend from your balance instantly.

There are also no setup or monthly fees.

Additionally, Paypal’s user-friendly interface has made it a go-to service for freelancers and clients alike. It allows both parties to transfer money without sharing financial information like credit cards or bank account numbers…and who doesn’t love a Pal that respects your privacy?

PayPal accounts also offer a payment portal, PaypalHere, that can be integrated into your website (and/or POS), making it even easier for clients to pay you.

However, while PayPal remains one of the leading payment methods globally, fees are one downside.

For payments you receive through PayPal, a 2.9% transaction fee will be deducted, based on the rate you receive, as well as a flat fee of 30¢ per transaction. While this percentage might seem negligible, it can mean losing thousands of pounds per year or more.

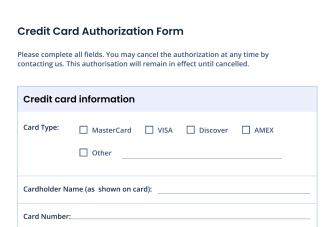

Credit cards:

Clients will likely be happy to pay via this tried and tested payment method when it comes to freelancing. Credit card payments are often processed through PayPal or another online payment system such as Quickbooks.

Clients will likely be happy to pay via this tried and tested payment method when it comes to freelancing. Credit card payments are often processed through PayPal or another online payment system such as Quickbooks.

You can also purchase credit card processing equipment to accept your client’s payment(s). You’ll need wireless credit card terminals and credit card processing software, or a merchant account.

If you’re using credit cards to accept payments, it means that your client is willing to pay for your services in advance - credit where credit’s due.

This makes card payments an excellent option for freelancers who are just starting out or have little experience and need time before they can start profiting from their business.

There are some drawbacks to using credit cards as a payment method for freelancers. For one, there’s always the risk of fraudulent transactions - something that could lead to chargebacks and lost money.

Additionally, many credit card companies also levy transaction fees - meaning you’ll be forced to pay extra for the privilege of using them, so make sure you do your research and don’t let this payment method swipe your earnings.

Google Pay:

Say goodbye to loose change and hello to complete and reliable mobile payments with Google Pay.

Say goodbye to loose change and hello to complete and reliable mobile payments with Google Pay.

Offering similar features to Samsung Pay and Paypal, Google Pay allows users to send money through email or deposit it into their bank account once they link the two accounts together.

Having the option to receive payment via email makes Google Pay great for dynamic projects and almost any situation where you need to get paid quickly while on the go.

While there are no fees for sending money through Google Pay, the platform does take a small percentage of the sale when used to pay for goods or services.

In addition, all transactions are final, and there is no buyer protection policy in place should you have an issue receiving your money. Another downside is that, like Paypal, Google Pay charges a flat fee of 30¢ per transaction.

Bank transfer:

If you’re working with a client who’s located in your country, bank transfers are a great payment option. Payment is instant, and you won’t have to pay any fees for the transaction.

If you’re working with a client who’s located in your country, bank transfers are a great payment option. Payment is instant, and you won’t have to pay any fees for the transaction.

However, don’t bank on this method for fast payments if you’re working with clients from other countries. Payment can take days to arrive, and fees will be added to the transaction by your bank.

Generally speaking, clients will also need access to a bank account to pay in this way - which isn’t always possible.

Escrow:

This method uses an escrow service (surprise surprise) to deposit the client’s payment in a secure account and release the funds into the freelancer’s account after they successfully complete the project. This makes Escrow ideal for freelancers constantly working with new or unknown clients who want to ensure they actually get paid for their work.

The main disadvantage of Escrow is the potential for delay in payment, as funds can take up to five days to clear into an escrow account. There have also been instances where payments have been ‘lost’ in the system, with no way of recovery. However, this does seem to be a rare occurrence and is most likely due to user error (not completing all payment information correctly).

Skrill:

Another freelance payment portal that is not as widely used as others on this list but is still worth considering if the clients are willing is Skrill. Known as Moneybookers, Skrill is ideal for freelancers regularly working with international clients as you can use Skrill to pay or get paid in over 100 currencies. It’s also one of the most popular online payment methods, with over 25 million users.

While freelancers might lean towards this method for its security level, there are fees for using Skrill, which vary depending on the currency you are exchanging and whether you’re depositing or withdrawing.

Paymo:

With Paymo, you really do get mo(re) for your money. Not only does this payment portal allow you to send and receive payments and track your projects in real-time, but it also has invoicing features that can be very useful for freelancers prone to invoicing late, and makes sure you get paid on time, every time.

Although Paymo is one of the most multifaceted payment options, it still has some drawbacks. This method is not available in every country, and so may not be suitable for projects involving international clients.

Break free from financial management with a reliable POS system

Financial management is a huge part of surviving as a freelancer, but it doesn’t have to be complicated.

Financial management is a huge part of surviving as a freelancer, but it doesn’t have to be complicated.

By choosing the right financial software to assist your freelance career, you can turn more of your attention to your projects and clients.

Let your electronic point of sale (EPOS) system handle things like bookkeeping and accounting tasks, while you select specific tools and insights on offer, to help you achieve your business goals.

With Epos Now, you can also:

- Create and send invoices using simple templates and a built-in VAT calculator;

- Receive and pay ongoing invoices automatically;

- Integrate with the business automation apps that are right for your business.