How to create a cash discounting program for your business

Cashless payments are undeniably convenient. They let customers complete transactions quickly without the need for physical currency, reducing hassle and even mitigating the risk of theft.

In 2023, cash was used in just 12% of point-of-sale (POS) transactions and a mere 1% of all eCommerce transactions in the US. Clearly, the world is moving toward cards and digital payments.

But here’s the issue, when you accept credit card payments, they tend to come at a significant cost to retail and hospitality businesses like yours. Every swipe, tap, or dip incurs fees. There's payment processing fees, merchant service fees, chargeback fees, non compliance fees, and sometimes even equipment and monthly fees. Collectively, these fees take a real toll on profit margins. And, for small businesses, already operating on thin margins, they can be particularly burdensome.

If that wasn't reason enough to like cash payments, there's more. Reliance on card payments also exposes businesses to operational risks. One system outage or technical issue and you've got a complete transaction stoppage, leaving customers frustrated and businesses scrambling to find a way to trade.

However, this doesn’t mean businesses should abandon card payments. In today’s economy, that’s simply not an option. What businesses can do, though, is implement cash discount programs. This guide will teach you everything you need to know about these programs answering questions like:

- What is discounted cash flow?

- Why should I start offering cash discounting?

- What benefits does a cash discount offer your customers?

- Is having a cash discounting program legal?

Let's get into it.

What is a cash discounting program?

A cash discount program is a pricing strategy in which businesses offer customers a small incentive (like a discount) when they choose to pay with cash instead of a credit or debit card. The goal is to encourage cash payments and reduce reliance on electronic transactions like credit card payments, for instance.

Now, when a customer’s paying, more often than not, they lean towards card payments. That's because they tend to be more convenient, quicker, and straightforward. Plus, a lot of credit cards offer fun incentives like air miles or cashback. Usually, cash doesn't have that same allure. But with cash discounting, it can.

With a cash discounting program your customers can enjoy your products or services at a reduced price and, in turn, you'll get to save money on credit card processing fees and other payment processing costs. It’s a smart, mutually beneficial approach that helps businesses protect their bottom line all while keeping their awesome customers happy and coming back.

How does the cash discounting program work?

If you're the type of person who needs an example to fully grasp a new concept, we've got you. Here's what a cash discounting program might look like:

Say you own a coffee shop. You sell a latte for $5. Now, without a cash discounting program, when customers make credit card transactions or pay with debit cards, the fees will eat into your profit margins. According to Motley Fool, the average processing fee is 1.15% to 3.15% per transaction. Let’s say your processor charges 3%. For every $5 latte sold on a credit card, you’re losing $0.15 in fees. That might not sound like much, but add in other fees (monthly charges, equipment fees, and compliance costs) and your profit margins shrink fast.

So, here's what you can do. Instead of eating those fees, you price your latte at $5.15, which includes the cost of card processing. Now, when a customer pays with a card, they’re covering that $0.15 fee themselves. But if they pay with cash, they only pay $5 because you waive the extra charge.

Benefits of cash discounting

Some perks include:

Decreases processing fees for merchants

Like all things business related, it's always going to come down to money. And, with around 20% of small businesses failing in their first year, who can afford to throw any of it away.

Credit card processing costs do just that. Every card payment comes with a long list of charges. These charges eat into profits, plain and simple. But by offering discounts for cash-only payments, you encourage customers to pay with cash and avoid those fees altogether. That’s money staying in your pocket where it belongs.

Encourages more cash transactions

If you have a credit card, you know that sometimes you want to spend on it because you get a ton of benefits from doing so. Some people rack up free air miles and treat themselves to a trip to Aruba, others get cashback or rewards points to use toward their next purchase. Some get concert ticket upgrades.

But, while those perks are great for consumers, businesses aren’t getting the same benefits. When you offer a discount for cash payments, you’re giving customers a reason to skip the plastic and pull out real money. You're literally doing what credit card providers do and incentivizing using a certain payment method.

Minimizes risk of fraud

A recent security report found something out that was shocking enough to make national headlines. Last year, around 52 million Americans fell victim to credit card fraud. Add everyone's losses up and this totalled a staggering $5 billion.

Think about that. Every swipe, every tap on a card, puts businesses at risk of chargeback, disputes, and fraudulent transactions. It also puts non-cash paying customers at risk of losing their hard-earned money.

Cash payments are secure. No middleman, no chance for card details to be stolen, no fraudulent transactions slipping through the cracks. When customers pay in cash, businesses avoid the entire fraud risk that comes with electronic payments.

Simplifies financial statements

Keeping track of your finances can sometimes feel like a full-time job. And, for a business owner who already has a pretty full-on, full-time role, that's not ideal. With credit card transactions, there are endless additional fees to track, disputes to resolve, and complicated reconciliations.

But when cash is the preferred payment method, everything gets a whole lot simpler. There are no hidden charges and no monthly statements to decipher. You just count the cash, make your deposit, and move on with your day.

The difference between cash discount vs. surcharge (aka non-cash adjustments)

A cash discount is when you offer a price reduction for customers who pay with cash, encouraging them to avoid credit card fees. It’s a way to save both parties money, and it’s legal everywhere.

On the other hand, a surcharge (also known as a non-cash adjustment, FYI) is an additional fee added when a customer pays with a credit card. This isn’t a discount, but rather a penalty for using card payments. Surcharges are subject to stricter regulations and are illegal in some states. Let's talk about those regulations from states and payment service providers (PSPs) now.

Is it legal to offer cash discount program in the US?

Let's get into if a cash discount program complies with the law.

The short answer is, yes, it’s legal. Cash discounting is permitted in all 50 states in the US There are no federal laws that restrict cash discount programs, making it a perfectly legal strategy.

Here’s where it gets a bit trickier. While cash discount processing is legal across the board, surcharge programs aren't. They're only legal in some states. They're restricted in some states like Connecticut, Maine, Massachusetts, and California. And you absolutely cannot put a surcharge on debit cards, that's illegal in all 50 states.

How to implement a cash discount program effectively

1. Figure out the regulations for cash discounts in your state

Make sure you know the legal requirements for cash discounting in your area. Different states have specific rules (we call them state laws), so check with local authorities or consult a legal advisor on card network rules. Find out about card networks in our handy guide.

2. Determine the discount amount

Next, decide on the discount you want to offer. It should be enough to motivate customers to choose cash, but not so large that it cuts too deep into your profit margins.

3. Update your pricing strategy

Adjust your pricing to reflect the payment discount. This might mean slightly increasing your base price or simply setting a fixed percentage off the total price for cash payments.

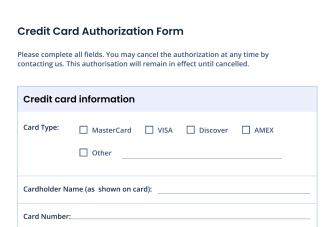

4. Create a discount in your POS system dashboard

Set up the cash discount in your POS system. Most modern systems allow you to create custom discounts based on payment method, so this should be a straightforward process.

5. Provide clear communication and signage about this payment option

Display clear signage in your store and on your website clearly explaining the cash discount. Make sure customers know they’ll get a better deal when they pay with cash.

6. Monitor and adjust your cash discount program

Once the program is running, track its success. Monitor customer participation, get some customer feedback, and see if it’s helping reduce credit card processing fees. If needed, tweak the amount or other program details to optimize results.

Payment processing services made simple

Take payments at one fixed rate - anywhere, any time.

Should you create a cash discounting program?

Starting a cash discounting program could be a great idea for your business! It helps you save on credit card fees and gives customers a reason to pay with cash.

Plus, it’s super easy to set up with Epos Now’s POS system. You can quickly add and manage cash discounts, making the process of this type of POS payment smooth and simple.

Our POS system also offers a ton of benefits. It’s flexible, so you can customize it to fit your business needs, whether you’re running a café, retail shop, or restaurant. The system tracks sales, inventory, and even helps with reporting, so you can stay on top of your business. Plus, its user-friendly design means less time spent learning and more time growing your business.

Want to learn more about how payment processing and our card machines can make things even easier? Speak to our brilliant team today.

- Is cash discount an expense or income?

-

It’s neither really, it’s more of a pricing strategy. You're just offering a discount for cash payments instead of taking a hit with credit card processing fees. So, it’s not a typical "expense" but a smart way to save cash.

- Are cash discounts tax deductible?

-

Sadly, no. Cash discounts don’t count as a deductible expense. They’re just an adjustment to the price of your goods or services. But hey, you’ll still save big on those pesky credit card fees!

- What are the disadvantages of cash discounts?

-

Well, it’s not all sunshine and rainbows. You may miss out on the benefits of credit card payments, like customer loyalty perks (points, air miles, etc.). Plus, it might take a little more time to explain it to customers. Speed being an important payment trend to consider here. However, when you factor in those savings from cash discounting merchant services? Totally worth it.

- What is an example of a cash discount?

-

Say you’re buying a $100 item. With a cash discount program, you offer a 3% discount for cash payments. So, the customer pays $97 instead of $100. It’s that simple. (You’re saving money too. Less fees and no need to use the complicated discounted cash flow formula when calculating your earnings). Want to make it even easier? Set it up in your cash discount credit card machine and let the savings and increased cash flow roll in. Free-reduction strategies, here we come!

Want to learn more about Epos Now Payments? Get in touch with our expert team today.