Gift Aid Admissions

Track admissions to your venue and events and ensure everything stays within tax rules with Gift aid Admissions.

Install now Not a customer?

Why Gift Aid Admissions?

Simple and fast

Completely compliant

Gift Aid Admissions is fully compliant and up to date with the latest charity tax rules and regulations.

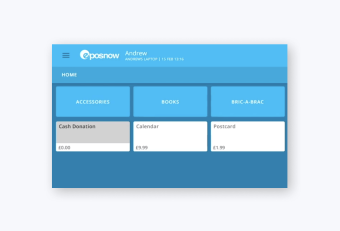

Cash ready

Charity cash donations can also be processed through the app, opening up multiple revenue streams.

Everything you need for charity admissions

In certain circumstances, admission tickets to your venue or events can be counted as a charity donation. Our Gift Aid Admissions integration ensures everything is counted as it should be to make the process easier for you.

- Manage donations at the point of sale (POS), simplifying the process

- Create a detailed list of admissions and the donations that came with them

- Automatically collate information that can be sent to HMRC

- Comply with all relevant tax rules and regulations

- Process cash donations using the app in addition to admissions

Install now Not a customer?

Cash donations made simple

Cash donations (donations made directly by a customer or via a donation box) can be processed directly through the app. This ensures you have a digital record of all donations and eliminates human error from the processing.

How Gift Aid Admissions works

After you download and setup the app, Gift Aid Admissions then:

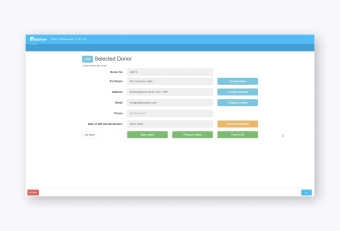

- Allows you to register donors at your point of sale system

- Prompts you to link the donor’s details when they buy admission to your venue or event

- Prints the donor’s details on the receipt

- Creates a record of donations which can be used to monitor performance

- Supports the generation of data for a claim to be sent to HMRC – either generated directly or linked to third-party software for claiming Gift Aid on donations