Card machines for small business needs

Build a better point of sale (POS) solution with Epos Now Payments and our range of long battery life portable card machines for sale.

The benefits of card machines and Epos Now Payments

No missed revenue

Save up to £150 of missed revenue a month with an integrated system and simplified transactions.

Time saving service

Speed up service by eliminating keyed-in transactions and save 10+ hours in admin each month.

Better card transactions

Accept your customers' preferred payment methods anywhere using portable card machines.

Boost business potential with a card machine for your small business

Epos Now card machines are designed to help small businesses operate at their maximum potential.

-

Take payments and orders from anywhere in your business and enhance your customer service

-

Accepts chip and PIN cards, contactless, credit and debit card payments

-

Split the bill, take tips, and fast receipt printing

-

Update stock availability, instantly manage your business, and review reports anytime, anywhere

Mobile card machines for small businesses

Find the right integrated card terminal for your business - from portable devices to stationary machines with near-instant payments.

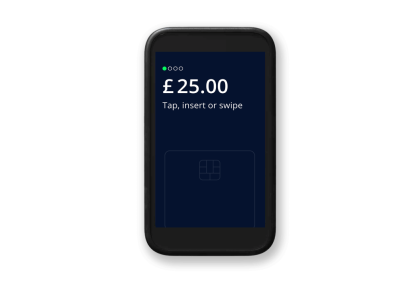

Take payments anywhere without a full POS system

Epos Now Payments Lite takes offline payments, even when there's no network connection. No more missed sales, and total sales security in the palm of your hand.

No hidden transaction fees in your card machine cost

We keep payments simple, secure, and stress-free. Epos Now Payments and card machines come with no hidden or monthly fees.

Enjoy clear fixed rates for card transactions, and accept mobile payments and all cards, including Google Pay, Apple Pay, and American Express, making it easy to budget your payment processing rate**. You'll also get free next-day payouts and offline payments capability included.

With an Epos Now credit card machine solution, you only pay for the necessary equipment.

Secure contactless payments

With an Epos Now wireless card machine, you can rest assured that your business account is in the safest possible hands.

-

Every Epos Now POS terminal is PCI compliant

-

We use highly secure encryption technology to secure our systems

-

Automatic cloud syncing means your data will be safe from data breaches and human error

Helpful support whenever you need it

Our card readers are a reliable option for any small business owner, equipped with all the tools you need, and the latest protection against POS malware. Should you need any help, however, our expert support team is ready and waiting to help.

-

Our UK-based support team is self-contained so you only need to call us, no third parties

-

Integrated payments support covers everything from contactless payments, card payment machines, merchant account options, and more

-

Instantly talk to a real person or via web chat between 9am to 6pm GMT

FAQ about business' card machines

If you'd like to know more about Epos Now Payments, our payment terminals, or our other Epos Now service, contact our expert team or read our frequently asked questions.

- What are the key differences between Epos Now card machines?

-

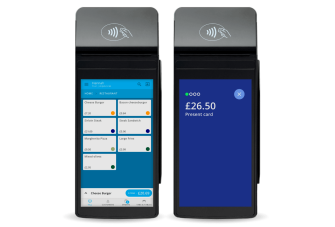

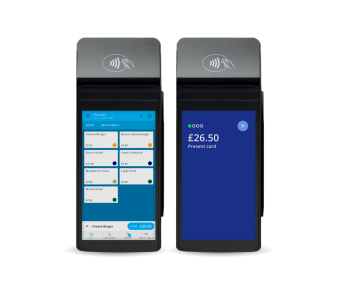

Epos Now offers a variety of card reader machines, including the Link, the Air, and the Pro+.

Link: Ideal for retail checkout aisles or restaurant payment counters, the Link is the perfect companion for any EPOS system. Its ergonomically angled touchscreen display and intuitive user interface allow customers to tap, insert, or swipe quickly. However, unlike the Air or Pro+, the Link is a countertop card machine connected through ethernet, designed to process payments at a fixed checkout such as a bar or sales counter.

Air: Built for speed and innovation, the Air mobile card machines allow you to accept payments quickly, confidently, and on the go. Split bills and print receipts from one portable device to introduce new levels of efficiency to your business.

Pro+: Run your entire business from your Pro+, the only solution you’ll ever need. Integrated with award-winning Epos Now software, it’s an all-in-one payments and EPOS device. Accept credit and debit payments with a quick contactless payment wherever they are on mobile devices that let you access reports and run your business in your own way.

- How do payouts with Epos Now work?

-

All transactions are collected at the end of the day and paid out the next day, excluding weekends and bank holidays.

Want your payouts quicker? Unlock fast access to your payouts and upgrade to Epos Now Payments faster payouts. Depending on your bank, faster payouts can include weekends and bank holidays, and you can set a cut-off time of your choice.

Epos Now treats your payments the same regardless of your payment gateway, a customer's payment card, digital card, or e-commerce payment system.

Talk to our sales team for more information on pricing, products, and more.

- What financial reports are available through Epos Now?

-

With Epos Now reporting, you can track your business in a way that suits you. With profits, turnover, and revenue, simple reports can monitor your bottom line, suitable for smaller businesses such as mobile hairdressers, pop-ups, or food trucks. Alternatively, you can search for business insights via detailed product, staff, and performance tracking.

Whether you have multiple business locations to track, want to monitor your countertop card machine performance, or want to stay on top of your payment fees, Epos Now reports can make it simple. Thanks to our cloud-based system, you can view multiple locations detailed performance wherever you are, whether at home, on any site, at the wholesaler, or even on holiday!

Use your Back Office portal to view all transactions in a single place, including individual transactions, insights and payouts, and monitor daily, weekly, monthly, and annual card turnover, profits, and more. Check when payments are processed and when the funds will reach your bank account. Access everything in one place and manage your cash flow easily.

Plus, you can integrate with common accounting platforms via our Epos Now AppStore to speed up your financial reporting.

- What fees do card machines charge?

-

Ready to start accepting payments? You'll want to know how much it costs. Card payment machine charges typically take similar forms, but how they're presented can often be confusing, leading to unexpected expenses further down the line that can damage your business' profitability. So let's break down the two main parts of your card machine costs:

-

Transaction fees. These are the typical rates for each transaction you make with a card machine. They can vary greatly across credit and debit cards, including Samsung Pay, Apple Pay, and Google Pay. Some are a percentage, some have a base rate, or a mixture of the two, so look at this part carefully!

-

Device or line rental. When you get a card machine, it's usually rented from major credit and debit payment processing companies. Some charge rental on devices and the phone line some card machines still operate through. However, many newer devices just need an internet connection (Wi-Fi connection if you want to go portable or an Ethernet cable for a fixed terminal) or even a mobile phone with data, saving several fees while providing equally secure payments.

Epos Now Payments has no hidden fees, but additional hardware fees apply - talk to us about options to support your business and receive a no-obligation quote on Epos Now Payments card machine price.

Charges per transaction:

-

Card payments = 1.7%**

-

Customer refunds = free!

-

- How do I choose a card reader?

-

The right card payment system can work wonders for your business, so it's important to think about what you need before making a deal and conduct thorough research to compare card machines rates and see what's on offer.

The first question is, when you accept card payments, how will you let customers pay? Chip and pin? Payment links you can send to absent customers? Do you need a contactless card machine? Or do you want more traditional credit card payments? It's important to know your preferred payment method before choosing your card reader.

Secondly, do you plan to have a fixed station for taking payments, or do you want a mobile device? If you need remote payments in addition to face-to-face payments, will your provider offer you the functionality you need, such as Epos Now's Pay by Link service?

Thirdly, how will you monitor your card machine? Transaction reports can be extremely complicated, making it hard to know how profitable your business has been daily. So, what reports will your card machine create, and how much work will it be to manage them?

Next, consider the market and the payment fees you can expect. How much, if anything, of the above will you sacrifice for the best transaction charges?

It's worth checking the security practices and reliability of EFTPOS card machine providers. However, the card payments industry is held to rigorous standards to protect customers from POS malware. For example, Epos Now Payments maintains ISO 8583 communications and full PCI compliance to protect card details and ensure you can rely on secure card payments.

These are all questions to consider as you research the market. Our friendly team will be happy to help you find the option that works for you.